Southbank mega-development inching closer to project start

Posted on January 3, 2018 By Editor Articles, Neighborhood News, Top Stories

“It’s not cast in concrete” seems to be the ongoing status when discussing the sale of Jacksonville Energy Authority land on the Southbank for the development project known as The District.

Although Elements Development of Jacksonville LLC had won the bid in 2014 to purchase the 30-acre property for $18.5 million and were scheduled to close on the sale in 2015, it received two extensions and then in late November a third, which included the condition that a $250,000 deposit would be nonrefundable.

After the third extension was approved by the JEA, an unexpected party entered the negotiations.

An email sent to the Downtown Invest-ment Authority (DIA) Board of Directors from developers Peter Rummell and Michael Munz suggested The District be “a public private partnership with the public benefit being multi-fold…,” proposing that the City initially buy the land from JEA and over time convey it back to Elements as development progresses.

This latest iteration of the planned sale was offered in a draft memorandum intended to be discussed at the DIA’s Dec. 20 board meeting. The meeting was cancelled, however, due to DIA Chief Executive Officer Aundra Wallace’s unavailability. Instead, the proposed agreement with the details of the City’s purchase of the JEA property for nearly $20 million will be discussed Jan. 4 at 9 a.m. at City Hall.

As noted at the beginning of the “for-

discussion-purposes-only” document, the agreement would need to be approved by several government and public entities, including City Council.

“DIA’s role is to determine whether the incentives and deal structure are good for downtown and the City,” said Oliver Barakat, DIA board member and senior vice president with CBRE.

Who bears the burden?

Elements has invested more than $2 million to date in legal fees, engineering, architect and master planning, marina permitting, market analysis, project permitting and fees, surveys, and consultants on land use and regulatory approvals.

“We have spent more than any other private sector developer in terms of the planning stages to move this 30-acres forward as a mixed-use master planned project in downtown,” Munz and Rummell stated in the email.

Referring to the project as the Southbank Catalyst Site, the email also notes it represents a new market for downtown Jacksonville and will “generate property taxes where none are paid today.”

The eight-page draft states the DIA would buy the eight parcels, paying JEA $1.859 million in cash and then making annual payments until 2040 for the balance of $17.59 million, a loan from the JEA to the DIA.

Funds in the Southside Tax Increment District (TID), including a 1.25-mills special assessment on the value of the improved property, would be used to pay off the loan at an interest rate of 2.57 percent, paid annually with a 10-year interest-only period and an 11-year amortization schedule.

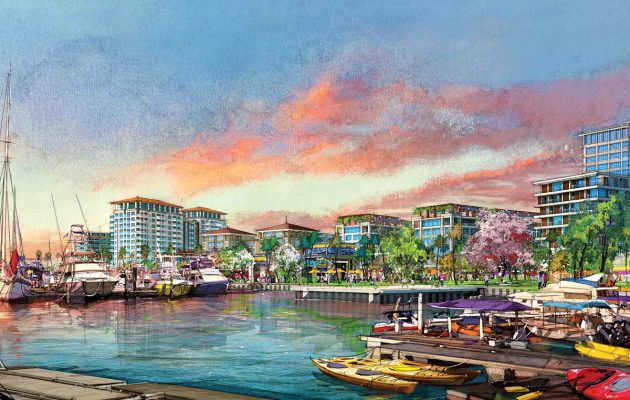

The DIA would also fund a portion of the public infrastructure for the project to the tune of a $26.41 million loan from the City of Jacksonville, with Elements funding $18.698 million of the $45.1 million public infrastructure work. The DIA would repay the City with 75 percent of the ad valorem taxes generated by the project. The horizontal infrastructure would include the extension and completion of the Southbank Riverwalk; a riverfront public park; public accessible roads and sidewalks; river activation points including a water taxi stop, kayak launch, marina and other water connecting activities; water, sewer and utilities, and public parking.

During this phase of work, the DIA will lease the property to Elements for five years with a one-year extension, but the developers would not pay rent unless they miss specific construction milestones.

Once 50 percent of the infrastructure is completed, the DIA will sell the property to Elements for $1 for each of the eight parcels as long as the developers have a signed purchase and sale agreement with a third-party purchaser, building permits in hand for at least 22 percent of the pro-posed development rights, and all acquisition and construction financing in place.

The memorandum sets the approval of the property assignment from the JEA to the City no later than March 30, with a closing date of July 16, 2018.

By Kate Hallock

Resident Community News

(No Ratings Yet)

(No Ratings Yet)