Real Estate on the Rise

Posted on September 5, 2018 By Editor Articles, Neighborhood News, Top Stories

Real estate in the historic districts has always been interesting to watch, as the market trends and indicators seem to both start, and finish, here. From rehabilitation of older homes, to infill projects that replace vacant lots, there’s never a dull moment as smart buys in real estate are always seeking profit margins.

The desirable nature of the older, established neighborhoods continues to attract buyers, those who are new to Jacksonville and those settling in the neighborhood they’ve always desired. Higher prices and less inventory are the common denominators, begging the questions “Do we sell? Do we settle in and renovate? Do we wait to buy? What will we buy on the other side of a sale as prices rise?”

An interesting dilemma ensues, as love for charming, historic neighborhoods continues to drive decisions and bring buyers to the table. At the same time, it lends to a feeling of satisfaction for homeowners already in their forever home watching their equity grow.

The current state of our local real estate market is full of question marks and decisions for both buyers and sellers. The Resident asked local real estate professionals to share their thoughts and lend their knowledge to the conversation.

Low inventory creates seller’s

market in historic neighborhoods

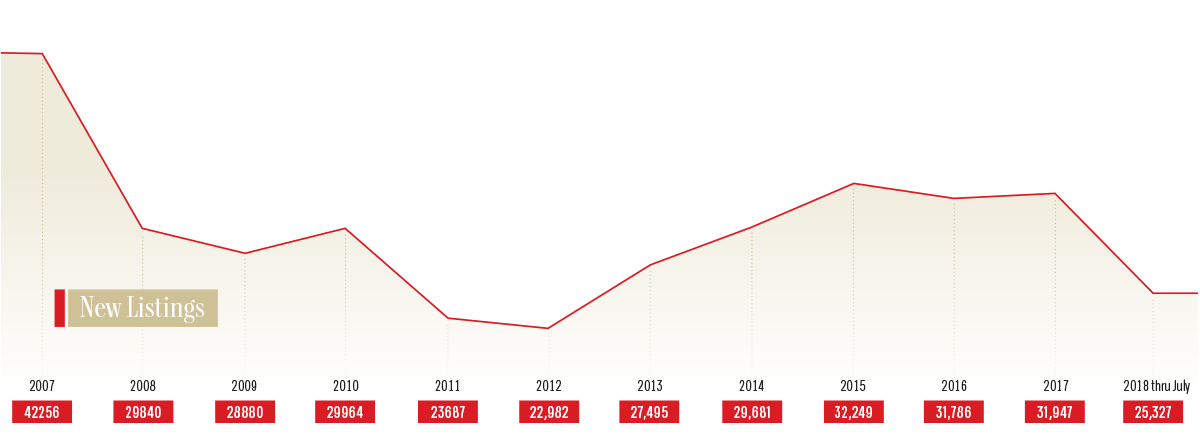

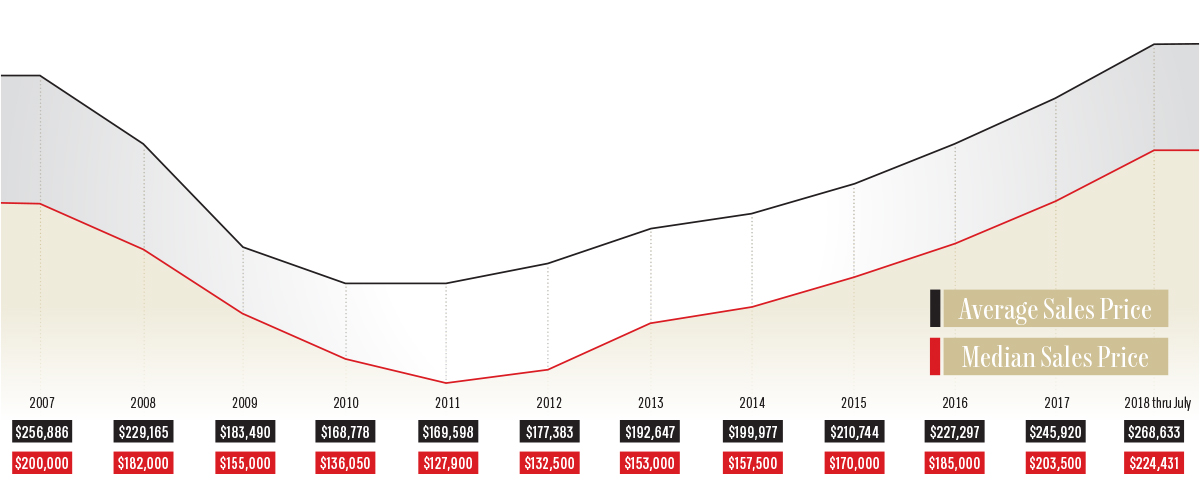

Housing prices back up 10 years after economic recession

The real estate market is on fire in the historic districts – there is no denying that fact. With rates and inventory remaining low, the market looks bullish and prices are on the rise. As sellers cash in, buyers continue to compete for the next listing that delivers the charm of the older, established neighborhoods.

Last year alone, Jacksonville recorded a population growth of 2.5 percent, which is twice the national average, so an increasing influx of new residents means homes in highly desired neighborhoods are increasingly in demand.

Coupled with a sharply reduced inventory in the historic neighborhoods, the wave of newcomers has created a seller’s market thus far in 2018. The inventory of homes in July was at a low of 3.7 months’ supply, far below the market balance of five to six months, according to a report issued in August 2018 by the Northeast Florida Association of Realtors (NEFAR).

“With a balanced market you have six to seven months of inventory where prices typically rise with inflation,” said Josh Cohen, managing broker for Berkshire Hathaway HomeServices Florida Network Realty, with offices in Avondale and San Marco. “With less than six months of housing supply you have a seller’s market. We are still in a seller’s market in most areas although inventory has been rising slightly, combined with a slight increase in mortgage interest rates. The word is out, and sellers are taking advantage of the friendly market climate.”

Cohen said in the Riverside, Avondale and Ortega neighborhoods there are 4.8 months of housing supply, a 20 percent increase in the past 12 months.

Demand for housing in the historic neighborhoods is very high, concurred Sally Suslak, broker/owner of Traditions Realty, based in Riverside.

“I believe people moving in have the hardest job finding a place to live because of the demand. This has been a trend for many years now and I see it continuing,” said Suslak. “One good result of this demand is that other areas adjacent to Riverside and Avondale have taken on a new life – especially Murray Hill. With more affordable housing, great things are happening up and down Edgewood Avenue.”

Housing is tight, too, in San Marco, according to Barbara Swindell, broker/founder of the 35-year-old agency, River Point Real Estate. “San Marco has always been a wonderful little community, almost like a small town, that sits in the center of a big city. We can get anywhere we want quickly,” she said. “You have a multiple layer of price ranges in this area, which makes for a wonderful neighborhood situation. Right now, the inventory in many price points is low.”

The historic neighborhoods are a specific niche market where people want the charm and character of homes in locations that tend to be near urban areas, said Missie Sarra LePrell, associate with RE/MAX, who noted home ownership in the older communities has been fairly consistent over the years. “Overall, living in a historical area is a specific choice because of the appeal of the architectural design of the homes and the feel of history that permeates the neighborhood,” she said.

Amanda Searle, broker associate for Root Realty, said more people want to move into, and purchase a home in, the historic districts. “It’s definitely going up compared to 10 years ago, and even just a year ago,” she said regarding the trend in historic home ownership.

Buyers’ woes, sellers’ joys

Even as buyers are lamenting the scarcity of available historic home properties, sellers are enjoying an average sales price of more than 8 percent higher than a year ago, according to NEFAR. The report also notes the length of time it takes to sell a home has also decreased – from 67 days in July 2017 to 61 days – a decrease of nearly 9 percent.

“In the San Marco, St. Nicholas and San Jose markets we are seeing appreciation combined with much lower inventory, which creates a buzz when that hot property hits the market,” Cohen said.

“A good percentage of homes sell for more than their asking price in some areas and price points,” added Suslak.

Increasing home values could also mean sticker shock for first-time buyers, especially those used to paying rent at Jacksonville’s average of $1,000 a month, according to rentcafe.com. To stay within budget, there are some older homes, mostly bungalows, that will keep them close to the same monthly cost, Suslak said.

“Depending on the interest rate, that payment would put you in the $125,000 to $150,000 price point,” she said. “You may get lucky and find a small home in the area. You will have more luck finding a small condo, but in both cases, you will have to look hard.” Swindell echoed that point, saying the beginner’s market in home buying is roughly $150,000, but it’s a very small home.

However, on the bright side, Swindell sees a trend in downsizing. “Nationwide the broad-brush trend for several years has been downsizing. The general feeling today is ‘smaller is better’ – I think they are looking for less house, but with more useable square feet,” she said.

Suslak calls it “smartsizing,” saying “Whether they are just starting out, are middle-aged or empty nesters, I see people making decisions which are right for the way they live and for their pocketbook,” she said. “Most folks don’t want to pay for or take care of more house than they need.”

The current trend for sellers, however, seems to be trading up when it’s their turn to purchase. “According to statistics, the current trend for sellers is definitely to trade up with over 52 percent of the market going in that direction,” said LePrell. “About 28 percent of buyers purchase the same size home mainly because they want newer or a different location, and approximately 20 percent of buyers trade down, primarily the empty nesters not needing all of their space.”

Searle said she’s finding that millennials – those born between 1981 and 1997 – are leading the way in home buying but are looking for turn-key homes rather than tackling a renovation. “First-time homebuyers want home ownership experience first,” she said.

“The big group that’s buying now are the millennials,” agreed Swindell. “My children live within walking distance from me and I have no doubt their 20-something children may come back and live in the area; it seems to be a generational thing.”

LePrell also agreed that millennials are buying homes and looking for them in the historic neighborhoods. “The largest group of homebuyers recently has been approximately the 25- to 34-year-old age group at 26 percent, followed by 34- to 44-year-olds at 21 percent and then the 55- to 64-year-old group at 18 percent,” she said, but noted they aren’t ignoring renovations. “Buyers are not as afraid of purchasing older homes that are not in good shape because of all of the ideas and expertise generated by the myriad of TV shows offering advice and solutions.”

Renovating makes good sense

When it comes to a choice between buying a dream home or creating it within their current home, Suslak said residents who have been in their homes for many years are choosing to stay in them, renovate them and make their “forever home” their “dream home,” and Swindell is on the same page. “People have been renovating like crazy lately, preferring to stay where they are,” she said.

“There has been a large trend of owners preferring to renovate over buying in the past and in the present for the same reason – they do not have the money to pay for the newer home and the closing costs to buy and sell,” said LePrell. “In some cases, they just love their house and the neighborhood that they live in, but they have either outgrown their house or they need to update it.”

LePrell also said all the homes she sold in the past year were pre-owned versus new construction. “Many of these homes have become so much more attractive because of the tasteful remodeling and renovations. Even in the historical neighborhoods like San Marco and Avondale, for example, owners enjoy the marriage of the charm and character of the older architecture with the modern convenience and utility of the updated kitchens, baths, plumbing, and electric, etc.”

Suslak said 98 percent of her sales were the pre-owned, “lovingly used,” 100-year-old-plus homes in the historic neighborhoods, and Searle noted pre-owned homes made up 95 percent of her own sales.

“Both sides of the river are high-demand markets because of the desire for a certain landscape and lifestyle,” said Cohen. “Many people moving into the area want a historic home, walkability to shopping and dining, access to parks and nature, and historic homes offer authenticity and character that many buyers identify with.”

As far as who’s moving in, there aren’t enough residents moving out to open the doors. “I don’t know of too many people moving out of San Marco,” said Swindell, who has lived in that area for 69 years.

“The advantage of the niche market homes in the historical areas is that the sellers have the opportunity to stay in their beloved, charming neighborhood because there are smaller homes, bungalows, or larger homes to move into as their needs change,” LePrell noted, supporting the idea homeowners tend to repurchase in the same community.

Suslak estimates that about 85 percent of Tradition Realty’s buyers are from Northeast Florida. “The other 15 percent come from literally all over the world,” she said. “Jacksonville’s medical community, its colleges and universities and naval bases bring many people to this area for business. They love the area and recommend it to friends and colleagues as the place to live.”

What recession?

The 2007-2008 economic downturn seems, 10 years later, like a distant memory. Although homeowners all over Jacksonville saw a depreciation then, the impact of the recession wasn’t as severe in the historic neighborhoods.

“Over the years, I have found if the market gets tight, we’re the last ones to feel it [in the historic areas] and when the recovery comes we’re the first ones to experience it,” said Swindell. “Things can be getting difficult and we won’t feel it nearly as quickly as other places and we do come back quicker, because of the parks, walkability – things you can do and get to by walking are a real plus. This is kind of a unique area.”

But whether it’s the unique neighborhood pockets found in Avondale or San Marco or elsewhere in Jacksonville, the real estate prognosis is still trending positively.

“I see the market staying strong and healthy for the immediate future,” said Suslak. “The economy is good, and this will allow people to continue buying homes.”

It doesn’t hurt, either, that Trulia listed Jacksonville as one of the top 10 real estate markets poised for growth in 2017 based on key metrics including high affordability, strong job growth, low vacancy rates, and home searches on Trulia. And, according to Forbes magazine, Jacksonville posted a 3.8 percent job growth rate in 2016, which makes it one of the healthiest markets for employment opportunities in the state.

Also, Jacksonville was No. 19 out of the top 20 cities where you could find a mortgage for $1,000 or less in April, according to gobankrates.com. At that time, a 4.25 percent mortgage rate was equal to $963 in a monthly mortgage payment – perhaps just enough for a small starter home in Murray Hill, where inventory seems to be slightly higher there than in other historic neighborhoods. A search at the end of August on Zillow.com for homes in the $100,000 to $125,000 range yielded 12 for sale in Murray Hill, but zero to five in other areas.

Millennial Joshua Garrett is a first-time homebuyer and, after renting for almost nine years, said he was at a point in his life where he was done sharing walls with his neighbors. While renting in Avondale, Garrett and his girlfriend spent over a year looking for a home with three bedrooms, two bathrooms but had a hard time finding anything that met their needs for less than $200,000 in Riverside, Avondale or Ortega.

“We eventually found a cute, nice-sized home in Murray Hill. It’s a 3/1 but has a flex room that we can turn into a bathroom,” said Garrett. “We saw quite a few houses in the Murray Hill and Lakeshore area that we would consider as move-in-ready but, in my opinion, you’re still not going to see a decent move-in-ready home for less than $150,000 they were mostly in the $175-200,000 range. People like us are moving to those areas, because Avondale, Riverside and Ortega have just become so expensive.”

Garrett, who grew up in Murray Hill and attended Ruth N. Upson Elementary School, also said they had to act fast because “any nice home in the historic neighborhoods that was going for $215,000 or less wouldn’t last more than a couple days to a week on the market.

“I’m happy to see the neighborhood making its way back to the quiet, family-friendly community that I remember as a kid and, truthfully, still is in most areas of the neighborhood. Hopefully it will be even better.”

By Kate A. Hallock

Resident Community News

(No Ratings Yet)

(No Ratings Yet)