Reed, South Shores residents still waiting for FEMA appraisals

Posted on September 5, 2019 By Editor Articles, Neighborhood News, San Jose, San Marco, St. Nicholas, Top Stories

It’s been nearly two years since Hurricane Irma wreaked devastation to the Reed Subdivision and South Shores neighborhoods, and, so far, all Chris Duguid has heard is “crickets.”

“We are planning on selling our home to the City of Jacksonville using FEMA (Federal Emergency Management Agency) funding,” said Duguid, a South Shores Road resident. “We are waiting, but the timeline keeps changing. It keeps being pushed out, so we are waiting for the estimates to come through – the assessments based on the comps we gave them pre-Irma. Then we can sit down and do the selling. So far, it’s been crickets chirping, and we are still waiting.”

Chronic flooding has been a way of life in sections of the Reed Subdivision and South Shores for years. Tidal flooding from the St Johns River and heavy rain from afternoon storms often saturates properties in the low-lying area between I-95 and St. Nicholas, causing street flooding. To mitigate the situation in Hurricane Irma’s wake, former District 5 Councilwoman Lori Boyer held a town meeting in November 2017 to introduce a possible solution – a buyout of homeowner’s properties with FEMA and city money to mitigate future losses in the neighborhoods.

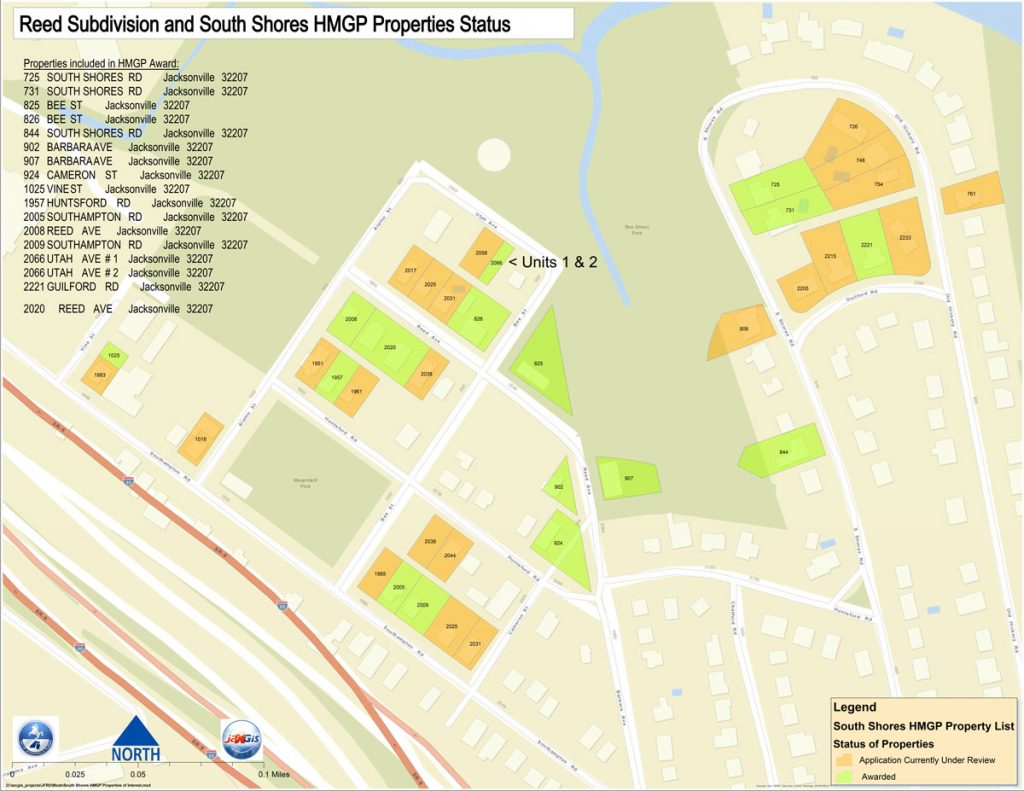

However, even though 37 of the 73 homeowners in Reed Subdivision and South Shores applied for the buyout, many residents feel confused and say they have received very little information from the City about the plan since it was introduced two years ago.

“Residents here are scratching their heads because they don’t feel they’ve been given enough information,” said Bobby Back, a Bee Street resident. He notes, at the time, Boyer claimed the City had studied possible solutions such as installing a pump system or higher bulkhead to alleviate flooding but said those solutions would not work and would cost too much. “I say, ‘show me,’” he said. “We pay taxes like everyone else. We don’t expect what happened with Irma to happen again in our lifetimes, and if it does, we know the drill.

“I don’t think the City has made any effort to resolve the flooding in Reed Subdivision,” he continued, adding that during the meeting, he heard John Pappas, Jacksonville director of Public Works, say he had never visited Reed Subdivision. “We know the history of our neighborhood. The City is not interested. They say there is nothing you can do about the flooding. Well, there must be something you can do about it, and if it turns out it’s too expensive, that’s fine, I can understand that, but we don’t know what has been talked about, looked at, or even if anything even has.”

Back said he would be willing to play ball with the City, if he felt he had enough specific information about possible solutions the City has considered.

The buyout program stipulates homeowners be paid pre-Irma prices for their property by the City, which would then demolish their homes and restore the land to wetlands. The program is voluntary. Property owners can withdraw at any time during the process, which can take up to two years.

In May, the Mayor’s Budget Review Committee approved a $4.6 million plan to buy and demolish 17 homes. The City is still considering whether to seek federal dollars to cover 17 more. FEMA is to contribute 75% of the money to cover the mitigation program, with the City of Jacksonville paying the balance.

Although Back’s home was approved for the buyout, he is not planning to go anywhere. His land has been in wife’s family for 100 years, and it has never experienced flood damage until Irma, he said. He estimated of the 17 homeowners approved for the buyout, only a handful will take it.

“We were part of the 17, but a lot of us weren’t really sure what we were going to do. We filled out applications so we would have an option if we needed that option. Nobody knows what’s going on. They still haven’t done any appraisals, and when they talk about giving you fair market value pre-Irma, they don’t consider that houses in this flood plain are sold within a few days after they go up for sale and for a lot more than the pre-Irma value is.”

According to James Croft, a city spokesman, “pre-Irma appraisals are expected to be conducted in September or October 2019, after which time they will be distributed to homeowners for consideration, but Back is correct in saying housing prices have climbed in his neighborhood. According to Anita Vining of Berkshire Hathaway in San Marco, the South Shores area is a seller’s market.

“There are two homes on the market there, and they are both under contract,” she said. “Six homes have sold in the last 12 months. There are currently 3.5 months of inventory, which indicates a hot seller’s market! With interest rates at lows we have not seen since 2016, motivated buyers are out there shopping for homes, and sellers should take advantage of this friendly market climate.”

Missi Howell of Watson Realty in San Marco agreed. “In general, we have seen a demand in housing priced under $300,000 for the last five years. Couple that with homes in popular locations and the homes do not stay on the market long,” she said. “Even with the hurricane, I think people see Irma as a once-in-a-lifetime event, and while the damage was devastating to those who lived through it, there is still a demand for housing there. Flood insurance certainly helps mitigate losses, and some people find the desire to live in the San Marco/St. Nicholas area greater than the risk of flooding in the future.”

Sharon Scott, a Barbara Avenue resident whose home was buyout approved, said she had mixed feelings about whether to stay or sell. Her screened porch and garage were flooded, but no water entered her house, and FEMA compensated her with $10,000 to fix the damage. “I’ve been here 20 years, and that’s the one and only time it’s happened,” she said. Yet with FEMA’s appraisals nowhere in sight, she recently listed her home and had a signed contract within a week.

On Zillow, the popular real estate website, Duguid said the market value of his home has gone up 50% from its pre-Irma valuation. Yet he has no plans to put it on the market. “We get updates from Zillow that your house would be worth this, but they don’t take into account that your house has flooded. I don’t want to have to chase a contractor and renovate this space. I’m over that. I just want the City to follow its timeline and appraise the house, then sell the house to them, and check a box.”

After it was flooded with two feet of water, Duguid personally gutted his home days after the storm, so mold would not set in. He said his biggest challenge has been receiving three citations from the City for blight and unsightly conditions after taking instruction from city officials to store the debris under his carport until his house is demolished. “Every single week I come by and throw stuff away. Sometimes they collect it, sometimes they don’t,” he said, as he dragged three full trash cans to the curb because the City will not furnish a dumpster.

Meanwhile, several residents believe the City has a different agenda than just helping FEMA mitigate damages. “I think it’s a very politically motivated scheme having to do with The District that they’re building,” said David Gum, a longtime resident who grew up in South Shores and has lived in Reed Subdivision. “I think they want to turn Southampton Road into a bigger road so they can have another egress going into The District. Prudential Drive isn’t going to do it. It’s going to be crammed, and they are building new apartments, hundreds of them, just past the School Board Building. At the (November) meeting they said they wanted to turn this into wetlands, but I think it will be a sponge to aid in keeping it from flooding over there (at The District).

“If their goal is to turn this area into a sponge or one big retention pond then they should tell us,” said Back, adding he might take the buyout if the City would be open about its agenda. “We would certainly consider the buyout if it would help this part of town,” he said.

Back also questioned why, if his home is such a flood risk, his flood insurance is so cheap. He pays approximately $600 per year, he said, and his insurance cost has been reduced since Hurricane Irma. He also wonders how the neighborhood will be serviced if some houses are torn down and others remain.

“One of the things Mr. Pappas assured us at the meeting is that Public Works would give us the same level of service if we decided to stay,” he said. “We had a good laugh about that. There’s not much in our interactions with the City that give us confidence.”

(No Ratings Yet)

(No Ratings Yet)city of jacksonville, FEMA, flooding, Hurricane Irma, Lori Boyer, Reed Subdivision, South Shores