‘Geography of opportunity:’ Jessie Ball duPont Fund and The Reinvestment Fund present 2022 Market Value Analysis

Posted on March 8, 2023 By Editor Top Stories

Last month the Jessie Ball duPont Fund hosted a community event to discuss Jacksonville’s “housing ecosystem.” To do that, it welcomed Philadelphia-based The Reinvestment Fund to share its 2022 Market Value Analysis (MVA) for Jacksonville/Duval County.

An MVA, the presentation explained, is “a tool to help residents and policymakers identify and understand the elements of their local real estate markets…[With it,] public officials and private actors can more precisely target intervention strategies in weak markets and support sustainable growth in stronger markets.”

This is the third MVA The Reinvestment Fund has conducted for Jacksonville.

“We think this is incredibly valuable to understand the real dynamics of housing values here in the city,” said Jessie Ball duPont Fund President Mari Kuraishi.

The 2022 MVA analyzed and discussed a variety of datapoints for the Jacksonville housing market, from median sales prices and how those prices have changed since the previous two MVA’s to how homeownership, rentals, foreclosures and home vacancies have fluctuated in the years between past analyses.

It also identified and discussed “critical themes illuminated by” this year’s MVA.

One of these “critical themes,” noted The Reinvestment Fund President of Policy Solutions Ira Goldstein, is what he calls “the geography of opportunity.”

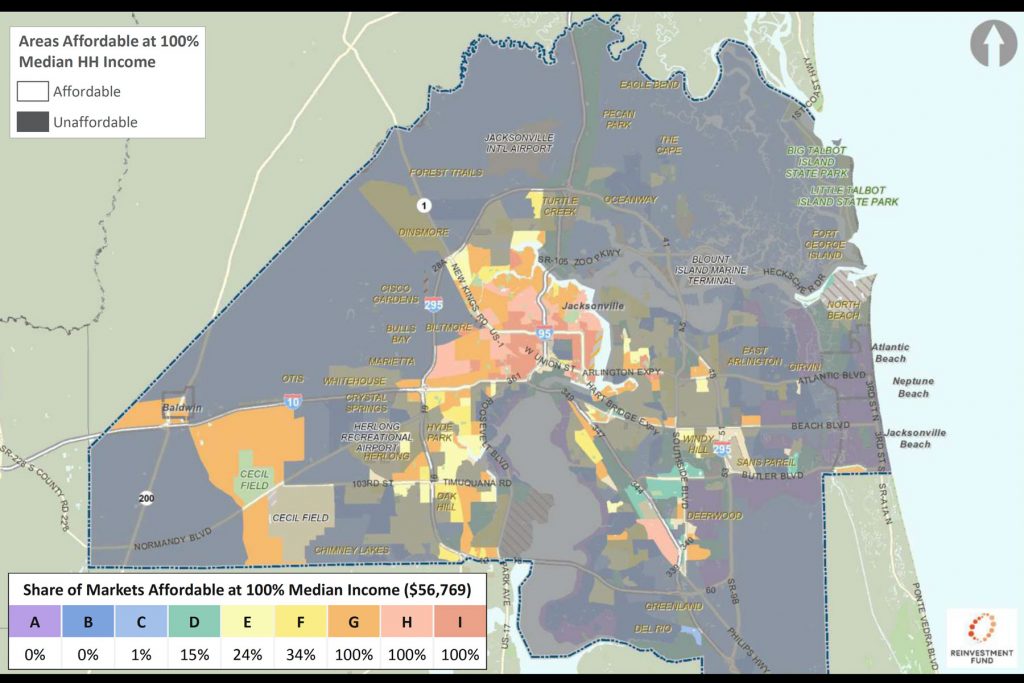

With the median annual household income in Jacksonville averaging around $56,000, the MVA underscored the “narrow” areas in the city and county that are affordable for a typical household just meeting the threshold for that average income.

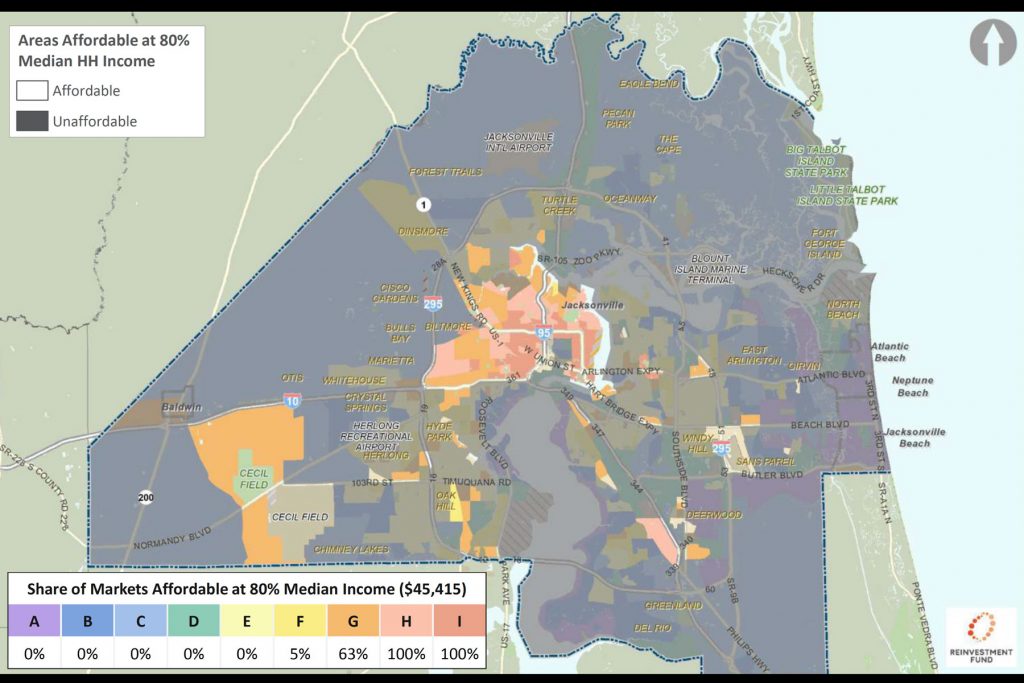

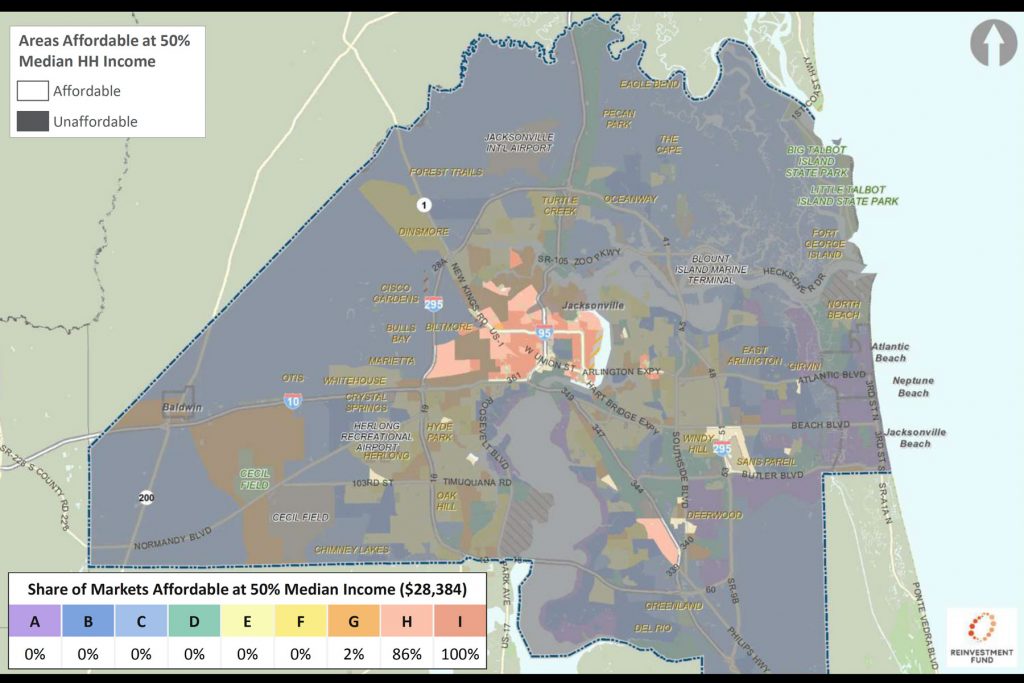

The MVA broke it down further by households earning 80% and 50% of the median household income, showing how the radius of the areas with affordable housing continued to constrict for households with lower incomes.

“We think that these different markets are not only about the housing markets but what they offer to people in terms of access to schools and parks and rec centers and libraries and all the other things that go with space,” Goldstein explained. “If you make half of median income, your geography of opportunity is very, very constrained here.”

The MVA also pointed out that the “geography of opportunity” fluctuates based on race as well, with white residents earning 100% of the median income able to afford “most middle market areas” while Black and Hispanic residents with “typical incomes” have a “similarly constrained geography of opportunity.”

Following the MVA presentation, Jessie Ball duPont Fund Director of Impact Investing Chris Crothers discussed various ways “equitable access to housing” is being addressed in Jacksonville. He highlighted four programs and strategies that are currently underway or expected to begin this year, including the Jacksonville Community Land Trust, the proposed JAX Affordable Housing Fund, CHDO/CDC Capacity, led by The Community Foundation for Northeast Florida in partnership with LISC Jacksonville and heir’s property work, led by LISC Jacksonville in partnership with Three Rivers and supported by United Way of Northeast Florida.

Later, in an e-mail, Crothers expanded on the importance of the data provided by the MVA, adding that it “can direct policy interventions, as well as investment from the public, private and nonprofit sectors.”

“…This new MVA shows us that with the appreciating real estate market, there are fewer areas of town that are affordable to residents who have jobs as teachers, police officers, or construction workers,” he continued. “These are jobs that are close to Jacksonville’s median household income–and there are fewer places today where people making a median income can afford to buy or rent compared to three or seven years ago. If we do not act now, it means that many of our neighbors will have no choice but to either move farther out or spend more of their paycheck on housing, making them housing cost-burdened.”

February’s event was recorded and is available in its entirety for viewing on the Jessie Ball duPont Fund’s YouTube channel.

By Michele Leivas

Resident Community News

(No Ratings Yet)

(No Ratings Yet)Chris Crothers, Ira Goldstein, Jessie Ball duPont Fund, Mari Kuraishi, Market Value Analysis, MVA, The Reinvestment Fund