Industry experts predict housing market maintains strength into 2022

Posted on March 1, 2022 By Editor Top Stories

Local real estate professionals are solidly in agreement that the home-buying frenzy in the past two to three years will continue, albeit at a slowing pace, throughout 2022. The pandemic’s obvious side effects coupled with low mortgage rates and office workers moving from in-office to remote work have created a perfect storm for the housing market. One cannot help failing not to mention, the flight to Florida for less burdensome restrictions on living standards and pandemic safety measures.

“I don’t think 2022 will be when we see it slow down much,” said realtor Neil Bridgers, office manager for Watson Realty Corp’s San Jose office. “All economic indicators point to a continuation of a hot real estate market across the nation. Rent also continues to climb, so this is only going to spur more people to get off the fence and start looking for options to buy a home.”

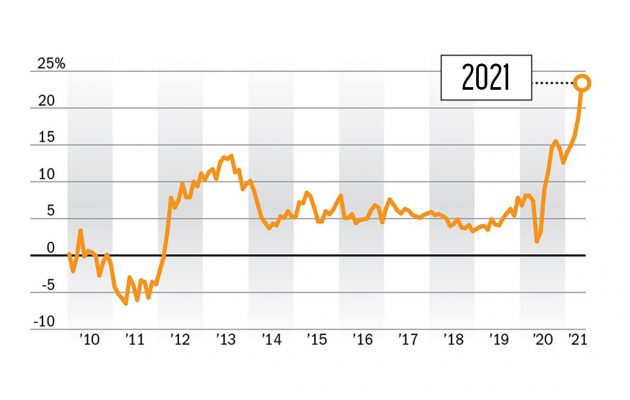

“Housing price increases will probably be in the 1% to 5% range compared to a 25% increase last year,” said Janie Boyd, realtor, broker/owner of Janie Boyd & Associates Real Estate Services. “Mortgage lenders were very careful about making ‘good’ loans, and many buyers paid a lot upfront to get an offer accepted and there were a lot of cash sales.”

Ted Miller, managing broker for Miller & Company Real Estate in Ortega said, “We expect interest rates to tick up a little bit, but when you add that into the mix of low inventory and high demand, it won’t slow us down much in the coming year. This year will be consistent with 2021, with tight inventory and high demand.”

“This is a seller’s market,” said Sally Suslak, managing broker for Traditions Realty in Riverside. “With the Federal Reserve raising interest rates – currently 3-1/2% from the high 2% rates six months ago and predicted to go to 4-5% – buyers will have to change what they can buy. Sales prices will probably not go down, but they will be increasing more slowly throughout 2022.”

The Northeast Florida Association of Realtors (NEFAR *-See attribution) reports that, as of January 2020, Duval County’s median home sales price was $300,000, up 22.4% from a year ago and 5.4% lower than the month prior. Median days home stayed on the market increased by 5% from a year ago and compared to the month prior by 5%, and 36.1% of homes closed over list price, a whopping 128.2% higher than a year ago and 6.3% higher than in December 2021. List price received was 99.4%, an increase of 1.5% over a year ago and .1% higher than in December 2021. There was only a 1.4-month supply of housing inventory in January 2022, down 22.4% percent from a year ago and up 38.2% from the month prior.

“Baring any unforeseen dramatic economic events in the country, the greatest factor that will change the market will be rising interest rates,” Bridgers said. “I believe that continued house demand coupled with lower buying power will help us start to see inventory open up.”

In response to rising mortgage interest rates, the rental market will continue to increase as well.

“The rental market is very competitive, too, making it difficult to find a rental right now,” Miller said. “We started to see an uptick in Spring 2021 in investment companies buying homes to rent out. That has calmed a bit in in-town and historic neighborhoods, but it is rampant in planned communities, because newer homes require less work for investment managers to get ready to rent and they are in a centralized area.”

The Sunshine State is the place to be

“We’re seeing a lot of migration to Florida and within the state from south Florida to north Florida,” said Miller. “We’re a more affordable market, and remote work has made Florida more attractive. And as South Florida continues to grow and expand, people want to stay in the state but in a less congested area.”

“Both working people and their families and retirees are moving to Florida,” Miller said. “Retirees are moving here to be closer to their kids, perhaps in reaction to the pandemic that made it hard for them to travel to see family. And I’ve definitely noticed more multigenerational moves with parents and their adult children moving together to the state.”

“Jacksonville was just named the number two city on Zillow’s top 10 markets in the United States for 2022, so I feel we are going to continue to see an increase in out-of-state buyers,” Bridgers said. Zillow named Tampa as the top market. Jacksonville is followed by Raleigh, N.C; San Antonio, Texas; Charlotte, N.C.; Nashville, Tenn.; Atlanta, Ga.; and Phoenix, Ariz.

“A lot of new businesses are moving here. They see Florida and Jacksonville as an amazing long-term opportunity,” said Alex Sifakis, president of JWB Real Estate Capital in Jacksonville. “Developers are seeing that Florida with its weather, lower tax environment, no big lockdowns – has tailwind while other cities have headwind.”

“More people are moving into Florida, but there isn’t enough inventory for them,” Suslak said. “The new apartments are filling up very quickly. The older population is moving into the luxury apartments.”

“For someone wanting to rent or buy, there’s not a lot of supply,” said Sifakis. “We can’t get land developed and housing built fast enough. I could sell 1,000 houses this year, but we can only build 500-600.”

“The area is experiencing much higher rent and sales prices,” he said. As interest rates go up, demand will increase. At some point this will level out but definitely not this year and maybe not for another two to three years.”

“You can’t go into any community and buy a new home that is available right now,” Miller said. “You have to be willing to wait, or, if you have an immediate need for housing, you basically have to take what’s in front of you or find something to rent until you can get what you want.”

“Affordable housing for first-time home buyers in the $100,000 to $300,000 range is extremely difficult right now,” said Miller. “There is lots of investor activity in the $200,000 to $300,000 range and five to 10 potential buyers for every listing.”

Jacksonville’s historic neighborhoods are hot, hot, hot!

“In my view and from talking to people around the country who are considering moving, the secret is out – Jacksonville is a wonderful place to live,” Miller said. “The historic neighborhoods remind people of places where they grew up or of similar neighborhoods in the North that they’re fond of. Our restaurants, shops, parks, sidewalks, weather and our friendly way of life is appealing.”

“People wanting to move into historic neighborhoods see residents enjoying their communities and they want to be part of it,” said Miller. “The future is very bright. We have a good seasonal and financial climate.”

“I don’t think that prices will ever be lower than now, even more so in historic neighborhoods, because you have demographic shifts with people wanting to live there and revitalize,” Sifakis said. He predicts that historic neighborhoods will have even higher and faster appreciation than elsewhere.

“It’s a mix of who wants to move into the historic neighborhoods with their great diversity – all sizes of homes, duplexes, quads. They are walkable and have great retail options. They’re diverse in terms of people as well – younger people in their first job, single people working downtown, seniors downsizing,” Sifakis said. “These are people who want to be near an urban area because that’s what they’re used to.”

“The main difference in historic homes sales versus new homes sales is simply availability,” Bridgers said. “The demand for historic homes in neighborhoods such as Avondale, Riverside and San Marco remain high while inventory in these neighborhoods remains low.”

“There are very few historic homes for sale,” Boyd said. “They are snapped up by local neighbors just waiting for one to come up. Buyers like having no HOAs to deal with.”

What home buyers need to know

The area’s aggressive home sales price presents challenges for buyers, however.

“In the historic neighborhoods we are seeing first time home buyers being pushed out more and more as prices go up,” Bridgers said. “You also tend to see more cash buyers in these neighborhoods, and someone looking to finance typically can’t compete with them.”

“My suggestion any buyer looking to combat this situation to make sure you have an aggressive agent on your side, meaning they are quick to respond to you, quick to get you in homes or give you a video tour and has experience writing competitive offers. Also remember a competitive offer isn’t just about a higher purchase price,” said Bridgers.

“Get with an agent who has a finger on the pulse of the neighborhood you want to be in,” Miller said. “Have your financial affairs in order and get preapproved so that you have the ability to be nimble if something you want comes available.”

“Keep your wits about you. Don’t overpay,” said Miller. “Balance what you need with your risk tolerance. Multiple bids can wear on a buyer. Understand the risks, be comfortable with the amount you’re paying and be aware of what you’re buying in terms of the age and condition of the home. Consider whether the neighborhood can support the price you’re paying for the house and keep an eye on resale.”

On the other hand, for buyers who are planning to live in the home until they can realize the equity they want, paying over asking price isn’t necessarily a bad strategy, according to Sifakis.

“Home prices are going up faster than appraisers are willing to adjust their comps,” he said. If five people offer $200,000, then that’s what the house is worth.”

“In this market, it is important for a buyer to be preapproved and prequalified, because you’ll need to move quickly when a home you want comes on the market,” Wilson said.

Sifakis says that buyers will need to persevere and may need to consider an off-market deal. Most generally, “off market” means that a property wasn’t listed on the MLS by an agent.

“Real estate investor groups will buy and sell homes at a lower price because the place needs some work,” Sifakis said. “Buying a house that needs work is one way to get a house that others wouldn’t buy.”

“Make your best offer. If your first offer isn’t accepted, ask for your offer to be accepted as a back-up in case the first offer falls through,” said Suslak. “Some sellers want their home to be sold to a person rather than an investor, but the buyer needs to have all of his ducks in a row and be ready to move fast.”

“But don’t be discouraged. The market always changes,” she said. “Never buy something you’re not 100 percent comfortable with. Listen to your gut.”

Suslak warns against writing a “buyer love letter” to a seller explaining why the house should sell to the buyer.

“That is a fair housing violation,” she said. “The realtors are instructed not to pass on those letters or even accept them.”

According to the National Association of Realtors, while this may seem harmless, these letters can actually pose fair housing risks because they often contain personal information and reveal characteristics of the buyer, such as race, religion, or familial status, which could then be used, knowingly or through unconscious bias, as an unlawful basis for a seller’s decision to accept or reject an offer.

Institutional investors are complicating the market as well.

“First-time home buyers are competing against investors to get properties in their price range of typically $250,000 or less,” Suslak said. “These institutions come in from out of state with money from investors to buy and rehab properties to sell. When that doesn’t work out for them because rehab costs are higher than they expected, they just rent them out.

“The major problem with these large investment companies coming in and sometimes buying up an entire street of homes in a neighborhood is quite simple,” Bridgers said. “Historically renters don’t take care of a home and neighborhood like owners do. People who rent a home have very little nothing invested in that home or neighborhood which leads to less maintenance and improvement on the home and often leaves yards looking less than ideal. We start to see the value of the neighborhood diminish.”

“Some investors are buying in the historic neighborhoods, but historically the prices are higher in those neighborhoods, so they’re more likely to buy in newer neighborhoods,” Suslak said. “Investors are not set up to do major renovation. They would rather buy a whole apartment complex.”

“The primary home buyers in the historic area are individuals,” Boyd said. “There are tons of investment buyers in the up-to-$300,000 range and for new construction less than 20 years old that require few repairs.”

What sellers need to know

“The two main ways to see equity in your home are time and improvements,” said Bridgers. “When a buyer stresses to me the importance of gaining equity in their home, I suggest that they think about ways they can add value to the home.”

“For a seller to be most successful in today’s market they should first meet with their realtor to discuss what a successful transaction looks like to them,” Bridgers said. “For some sellers this may be getting the most money for their home; for others it may be getting their home sold quickly. An experienced realtor will be able to guide them through the process and make recommendations for how to achieve the goal.”

“Whatever you think your house is worth, list it for sale at 15% or 20% higher. You’ll probably have multiple people bidding on it,” Sifakis said. “People moving from the northeast are used to paying twice as much for the same thing here.”

“It’s tempting to sell your home for a high price and then buy larger or downsize,” Miller said. “The people moving here want to buy in the next 30-90 days. You need to ask yourself where you’re going to move and what price you’ll have to pay if you have to move quickly.”

“We are seeing an increase in sellers selling to iBuyer companies, which is really unfortunate because those sellers are leaving money on the table,” said Bridgers. “I would encourage anyone considering selling their home to give a realtor a chance to list it before resorting to an online company that has to leave room to sell it at a higher price.”

*Source: Northeast Florida Association of REALTORS®.

By Karen Rieley

Resident Community News

(No Ratings Yet)

(No Ratings Yet)