Trends point to market stabilization

Posted on May 5, 2022 By Editor Top Stories

Buying still remains highly competitive despite low inventory

According to the Northeast Florida Association of Realtors, while sellers remained firmly in the driver’s seat by the end of the first quarter of 2022, several factors point toward a more moderate and stabilizing real estate market coming to Northeast Florida. NEFAR’s April report showed a combined total of 2,676 homes were available at the end of March – 7.5% fewer than February.

“The upside is the number of new listings is 3,144, up 14% in March compared to February,” said Mark Rosener, NEFAR’s president. “This trend should continue over the next several months, which will make it a little easier for buyers to find a home that meets their needs.”

Rosener said the additional inventory may be due to older millennials seeking to improve on their residences.

“There are signs that older millennials are looking to upgrade or upsize from their current homes, which is creating some additional inventory in first-time homebuyer price ranges,” he said. “However, these listings are quickly absorbed by the younger millennials who are looking to purchase a home for the first time.”

The combined median sales price of single-family homes, townhouses, and condos in Northeast Florida in March was $350,000 with single-family homes alone climbing to $370,050, a 4.7% increase. Meanwhile, the median sales price of single-family houses, condos, and townhomes combined was $350,000, a 4.5% increase over February and a 25% increase from last year at this time.

“The moderate month-over-month increase is in line with the median price trend since November of 2021 and is more evidence that pricing in our market is beginning to return to a more stabilized level. Increasing mortgage interest rates are now putting pressure on the home affordability index that dipped to 92 over the region in March, Rosner said.

The index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data. A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home.

According to NEFAR, sales remained brisk with only 15 days on the market as the median, a 7% increase from this time last year.

“Homes that closed or are under contract pending a closing are in line with historic seasonal trends with closed sales up 22.5% over closings in February and pending sales up 4.3%, Rosener said. “When compared to March of 2022, both closed and pending sales are down considerably as the first quarter of 2021 was inflated by pent up demand created by the COVID pandemic. All these factors continue to point to a slow movement toward a more moderate and stabilizing real estate market in Northeast Florida.”

Missy Cady-Kampmeyer, a real estate advisor with Compass realty company in Jacksonville, still feels like this is the time to buy.

“Interest rates have gone up and it is still a seller’s market, but it is also a buyer’s market because the rates are still much lower than they were years ago,” said Cady-Kampmeyer. “The main problem is not lack of inventory; it is a surplus of buyers. To be successful in getting the home they want, buyers need to ask the seller questions about what is most important to them and be flexible in meeting the seller’s needs.”

She shared the example of a seller who may not have extra money to make repairs before selling the house.

“The buyer’s agent can include an offer for the buyer to deduct the anticipated cost of repairs from the purchase price,” she said.

Cady-Kampmeyer also cautioned that “cash doesn’t always rule.”

“One reason why sellers tend to prefer all-cash offers is because those deals close more quickly. A cash sale can be turned over in a seven to 10 days. Closing on a mortgage may take 30 days or longer,” she said.

“I encourage the seller to consider whether they can wait the additional days to get the same amount of money. I would rather sell a house to a family than an investor, assuming the offer is the same. The seller will have the satisfaction of putting a family in a home. It’s better for the neighborhood too.”

NEFAR reports that, in Duval County, the March median price of single-family housing was $330,000, up 6.5% since February 2022. The median days on the market was 15, with 41.8% of sales closing above asking price and 100.7% of sellers receiving list price. Active inventory for the county was 1,184 homes, a decrease of 10.5% from last month and slightly less than a one-month supply. The Home Affordability Index registered at 98, down 5.8% from February.

“Thirty-three percent of homes in the Riverside/Avondale/Ortega are selling for over list price. We have 1.4 months-worth of inventory in our historic area, which is well under the six months that constitutes a stable market. The market remains highly competitive for buyers, but not impossible,” said Heather Buckman, who is the broker/owner of Cowford Realty & Design in Avondale. “Escalatory clauses, appraisal gaps, shortened inspection periods, free leasebacks for sellers – these are all tactics that are being used with success.”

“There is a lot of speculation right now about the market and whether it will crash. No one can tell the future, but we can say that none of the major economists are predicting any crash,” she said.

“For buyers who are wanting to wait until things slow down, that’s a bit of a gamble. Housing values are projected to continue to rise, and interest rates are also rising, so not only will the same house today cost more tomorrow, but the cost to finance that purchase will also be higher,” said Buckman.

“For sellers, it’s a different challenge. Many sellers say that they would love to tap into the equity of their home, but don’t know where they would move,” she said. “One strategy for sellers is to incorporate a lease-back into the sale of their home, where they essentially become renters in their own home on closing day, so that they can then go find something to buy without a contingency to sell their home.”

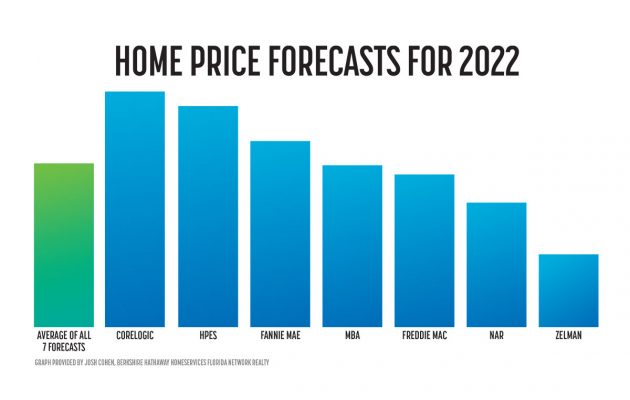

“Although there has been a slight uptick, inventory of homes for sale remains historically low. Most of the data we have seen from trustworthy sources like Core Logic, Fannie Mae and Freddie Mac forecasts that home prices will increase another 6.7% this year,” Josh Cohen, managing broker/coach of Berkshire Hathaway HomeServices Florida Network Realty, said.

“The market remains super competitive and multiple offers at all price points are the norm. Buyers have many options they can implement to ensure success and make their offer stand out to the seller. Professional consultation is vital,” he said.

Cohen suggested that if the property appraises for less than the offer price, the buyer can agree to cover a gap between the appraisal and the agreed upon purchase price.

“We recommend a cap dollar amount over the appraised value not to exceed the purchase price. The buyer can offer to pay all or a portion of the seller’s closing cost. This increases the sellers’ net profit without inflating the purchase price and could reduce concerns about raising value for financing/appraisal.” Cohen said.

“If you’re trying to sell your home, make sure you have a meaningful discussion with your agent on the marketing strategy,” he said. “While the agent is getting the property ready for showings soon, the agent can put out a ‘Coming Soon’ sign to get the neighbors talking. The agent can also begin showcasing all the home’s qualities on social media platforms sharing professional photos and video. This creates a nice ‘buzz’ and generates positive energy on the property.”

Cohen also advised reviewing best practices on how your agent will handle offers.

“It’s not always in your best interest to have a ‘best and final’ bidding process,” he said.

According to Investopedia, the best and final offer in a real estate bid is the most favorable terms the buyer is willing to offer the seller for the purchase of the property. A seller who receives multiple offers will resolve the situation by asking each bidder to submit only one offer that represents their best and final offer.

“Some buyers don’t want to be in a multiple bidding situation and could walk away from the property. Their offer that’s on the table could be the best scenario and the seller may not want to lose that opportunity. That said, every property scenario is different. Consult with your agent on what’s best for you,” Cohen said.

The most recent PropertyShark study, “The Gender Housing Gap Widens: Single Women Now Priced Out of 12 More Cities Than Men,” reported that Jacksonville is now the only larger city in Florida where singles can afford to independently buy a starter home, with women spending 27% of their income on mortgage payments compared to men spending 20%.”

“We tell our buyers every day that if they have a goal to buy in this market, it may not happen on the first offer that they write, but with some grit and perseverance, it absolutely can be done,” Cohen said. “On the other hand, with sellers sitting on record amounts of home equity, there has never been a better time to present your home to the world. Northeast Florida is wonderful, vibrant and growing,”

he said.

By Karen Rieley

Resident Community News

(No Ratings Yet)

(No Ratings Yet)Heather Buckman, Josh Cohen, Mark Rosener, Missy Cady-Kampmeyer, NEFAR, Northeast Florida Association of REALTORS